We have many roles in the Credit Union that are member facing, learn about the different positions below and check out our

open positions.

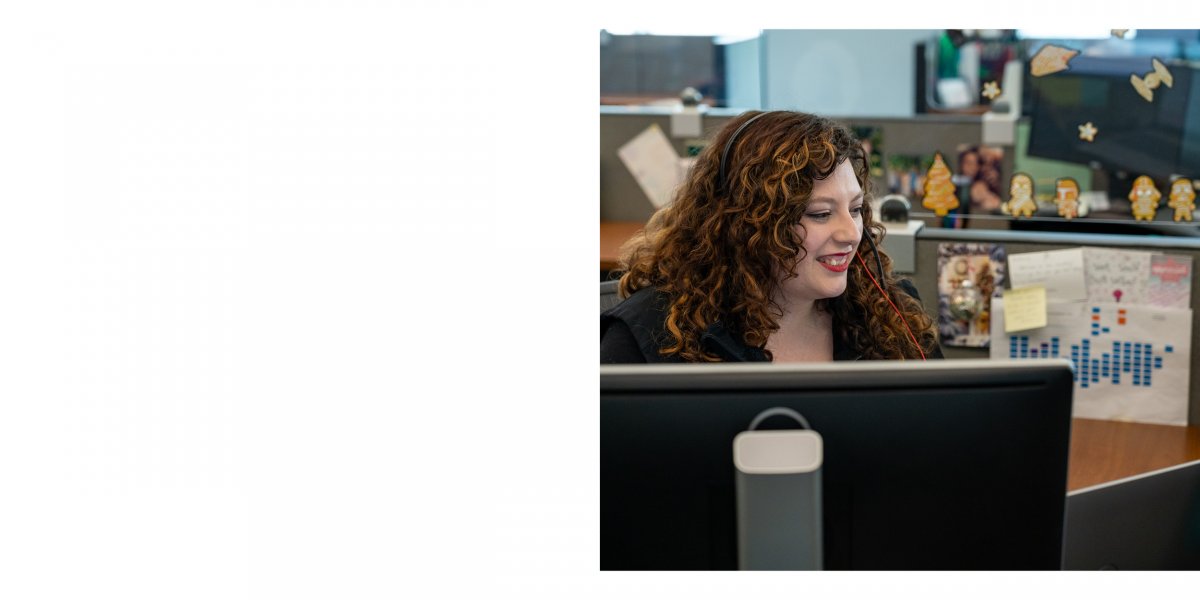

Call Center/Video Services: Members contact us from all over the world via phone or video chat. We can assist with anything and everything; we answer questions, educate, address any concerns, process loans, and help make their dreams come true.

eServices: We work as a team to provide superior service through our secure eMessage Center, Live Chat, and the phone, including account management, new account and loan applications, technical troubleshooting, and many other services.

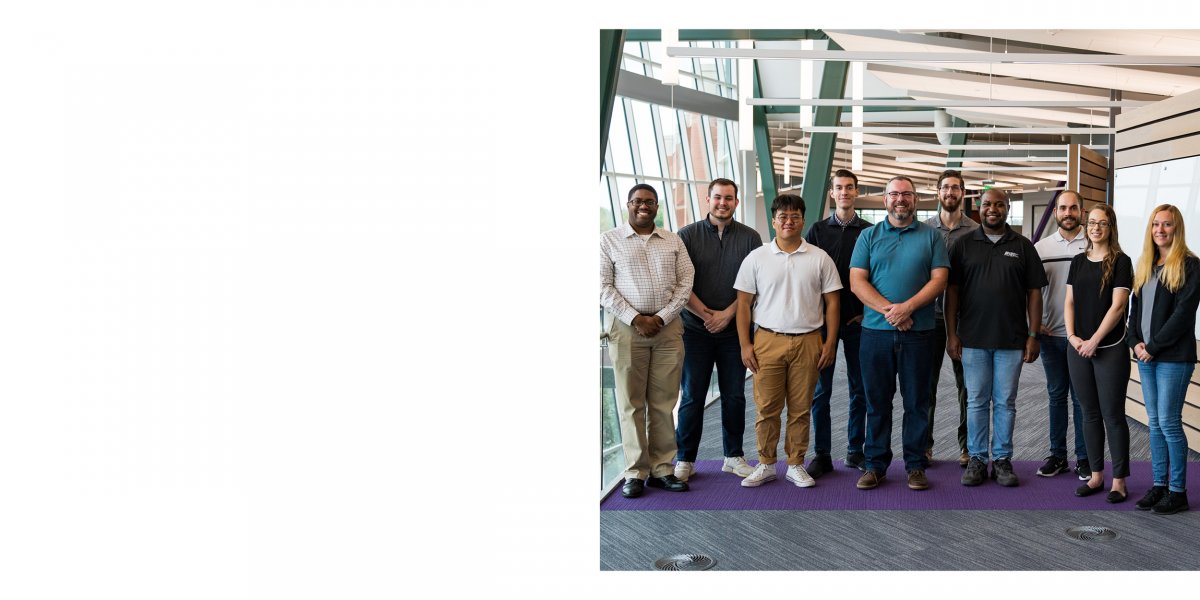

Deposit Operations: We manage and provide in-depth guidance on accounts with special features, such as IRAs/HSAs, Trusts, Power of Attorneys, Estate, International, Conservators, Representative Payees, Custodial and so much more.

Branches: We provide a consistent, in-person, member experience across our branches. All MSUFCU branches are full-service where we can assist in opening an account, setting up a savings or checking account, applying for a loan, and more.